invested

Invest in a secured loan

Residential building, building land (8th phase)

Yield represents the monetary amount you gain from invested capital. It indicates the difference between the final value of the investment and the capital used.

p.a. stands for per annum, meaning the yield calculated on an annual basis.

Example:

You invest 10,000 CZK with a yield of 10% p.a. The yields will be paid to you proportionally every month, and in one year, you will receive a total of 1,000 CZK in yields.

Maturity indicates the binding date by which the loan will be repaid and your investment comes to an end.

After this date, we will transfer to your account, along with the final yield, the original invested amount as well.

This investment has a maturity 31. 10. 2025.

Minimum investment specifies the lowest possible amount that can be invested in the project.

LTV = Loan to Value

(in translation, “loan to value”)

LTV indicates the ratio of the property value to the loan value. The lower the LTV, the higher the level of security.

Calculation of LTV = loan amount / estimated market value × 100

Yield represents the monetary amount you gain from invested capital. It indicates the difference between the final value of the investment and the capital used.

p.a. stands for per annum, meaning the yield calculated on an annual basis.

Example:

You invest 10,000 CZK with a yield of 10% p.a. The yields will be paid to you proportionally every month, and in one year, you will receive a total of 1,000 CZK in yields.

Maturity indicates the binding date by which the loan will be repaid and your investment comes to an end.

After this date, we will transfer to your account, along with the final yield, the original invested amount as well.

Tato investice má splatnost 31. 10. 2025.

Minimum investment specifies the lowest possible amount that can be invested in the project.

LTV = Loan to Value

(in translation, “loan to value”)

LTV indicates the ratio of the property value to the loan value. The lower the LTV, the higher the level of security.

Calculation of LTV = loan amount / estimated market value × 100

Get to know the project

Reading Time: < 1 minuteDescription of real estate collateral

- Lien in the 3rd order (all liens in the previous order are in favour of RONDA INVEST).

- Location and surroundings: The village of Dolni Brezany is located in the Central Bohemian Region, in the Prague-West district, about 1 km south of the Prague border.

- Technical condition of the property: The under-construction development project.

INFORMATION ABOUT THE

LOAN AND THE BORROWER

INFORMATION ABOUT THE

LOAN AND THE BORROWER

INFORMATION

ABOUT COLLATERAL

INFORMATION

ABOUT COLLATERAL

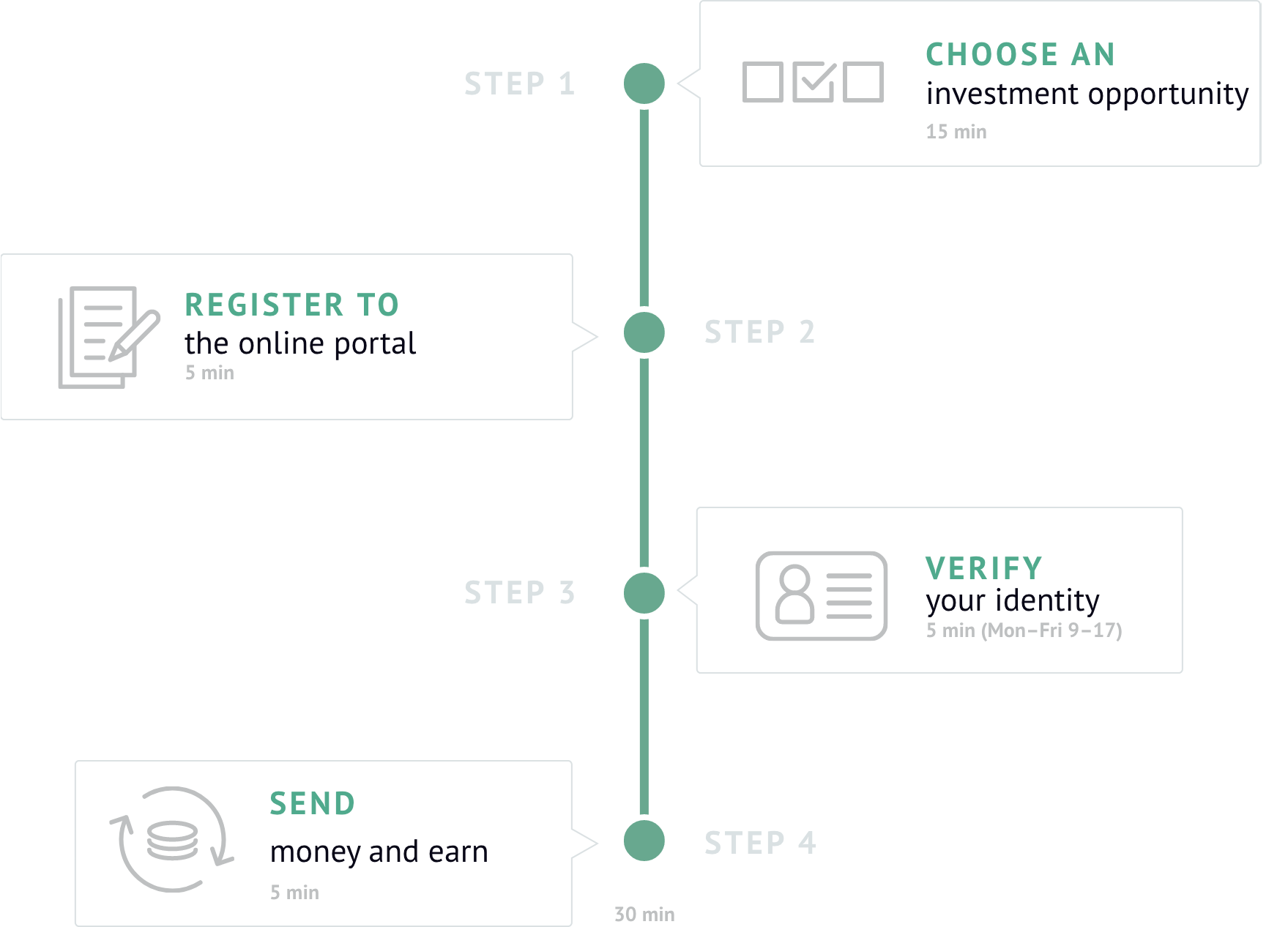

How it works?

FAQ

The returns are stated in percentage p.a., i.e. in the total annual percentage amount. However, you will receive a significant portion of the income from RONDA IVNEST into your account every month.

Along with registration with RONDA INVEST, an account with PAYMONT is automatically created for you, which will serve as your investor account linked to the platform. At the same time, we will credit you with income and return the invested amount to this account, and you can make financial transactions and transfers wherever you need from it and to it.

The original investment is always returned at the latest at the end of the loan maturity. The maturity of the loan is indicated in the description of each participation. In exceptional cases, it may happen that we return the investment to you a little earlier before the due date, when the credit client repays his debt early.

And in the case of, for example, developer loans, we return part of the principal already during the investment.

You can choose projects depending on whether you want to invest in Czech crowns or euros.

Both are possible, and thanks to the PAYMONT account it is also very simple, you can easily and profitably exchange one currency for another.

Current exchange rates are always at hand, visible in Internet banking.

Founded in 2020, PAYMONT UAB is an electronic money institution regulated by the National Bank of Lithuania with license No. 80, which allows offering comprehensive payment services throughout the EU.

The PAYMONT account is multi-currency, allows for immediate currency exchange without hidden fees, SEPA and SWIFT payments, and is accessible online in the form of internet banking.

We will set up an account with PAYMONT for everyone together with registration with RONDA INVEST, and it serves as an account for the payment of income and the return of the invested amount from the agreed participations. It is connected to the RONDA INVEST platform, so that in the event of an investment agreement, your funds are automatically collected from it and your participation is activated. At the same time, you can carry out financial transactions and transfers to any other account to and from it.

Keeping an account is free, as are most services. Some services are charged small amounts, as indicated in the price list.

Current offers

Yield represents the monetary amount you gain from invested capital. It indicates the difference between the final value of the investment and the capital used.

p.a. stands for per annum, meaning the yield calculated on an annual basis.

Example:

You invest 10,000 CZK with a yield of 10% p.a. The yields will be paid to you proportionally every month, and in one year, you will receive a total of 1,000 CZK in yields.

Maturity indicates the binding date by which the loan will be repaid and your investment comes to an end.

After this date, we will transfer to your account, along with the final yield, the original invested amount as well.

This investment has a maturity 31. 1. 2026.

Minimum investment specifies the lowest possible amount that can be invested in the project.

LTV = Loan to Value

(in translation, “loan to value”)

LTV indicates the ratio of the property value to the loan value. The lower the LTV, the higher the level of security.

Calculation of LTV = loan amount / estimated market value × 100

Yield represents the monetary amount you gain from invested capital. It indicates the difference between the final value of the investment and the capital used.

p.a. stands for per annum, meaning the yield calculated on an annual basis.

Example:

You invest 10,000 CZK with a yield of 10% p.a. The yields will be paid to you proportionally every month, and in one year, you will receive a total of 1,000 CZK in yields.

Maturity indicates the binding date by which the loan will be repaid and your investment comes to an end.

After this date, we will transfer to your account, along with the final yield, the original invested amount as well.

This investment has a maturity 31. 7. 2026.

Minimum investment specifies the lowest possible amount that can be invested in the project.

LTV = Loan to Value

(in translation, “loan to value”)

LTV indicates the ratio of the property value to the loan value. The lower the LTV, the higher the level of security.

Calculation of LTV = loan amount / estimated market value × 100

Yield represents the monetary amount you gain from invested capital. It indicates the difference between the final value of the investment and the capital used.

p.a. stands for per annum, meaning the yield calculated on an annual basis.

Example:

You invest 10,000 CZK with a yield of 10% p.a. The yields will be paid to you proportionally every month, and in one year, you will receive a total of 1,000 CZK in yields.

Maturity indicates the binding date by which the loan will be repaid and your investment comes to an end.

After this date, we will transfer to your account, along with the final yield, the original invested amount as well.

This investment has a maturity 31. 7. 2024.

Minimum investment specifies the lowest possible amount that can be invested in the project.

LTV = Loan to Value

(in translation, “loan to value”)

LTV indicates the ratio of the property value to the loan value. The lower the LTV, the higher the level of security.

Calculation of LTV = loan amount / estimated market value × 100