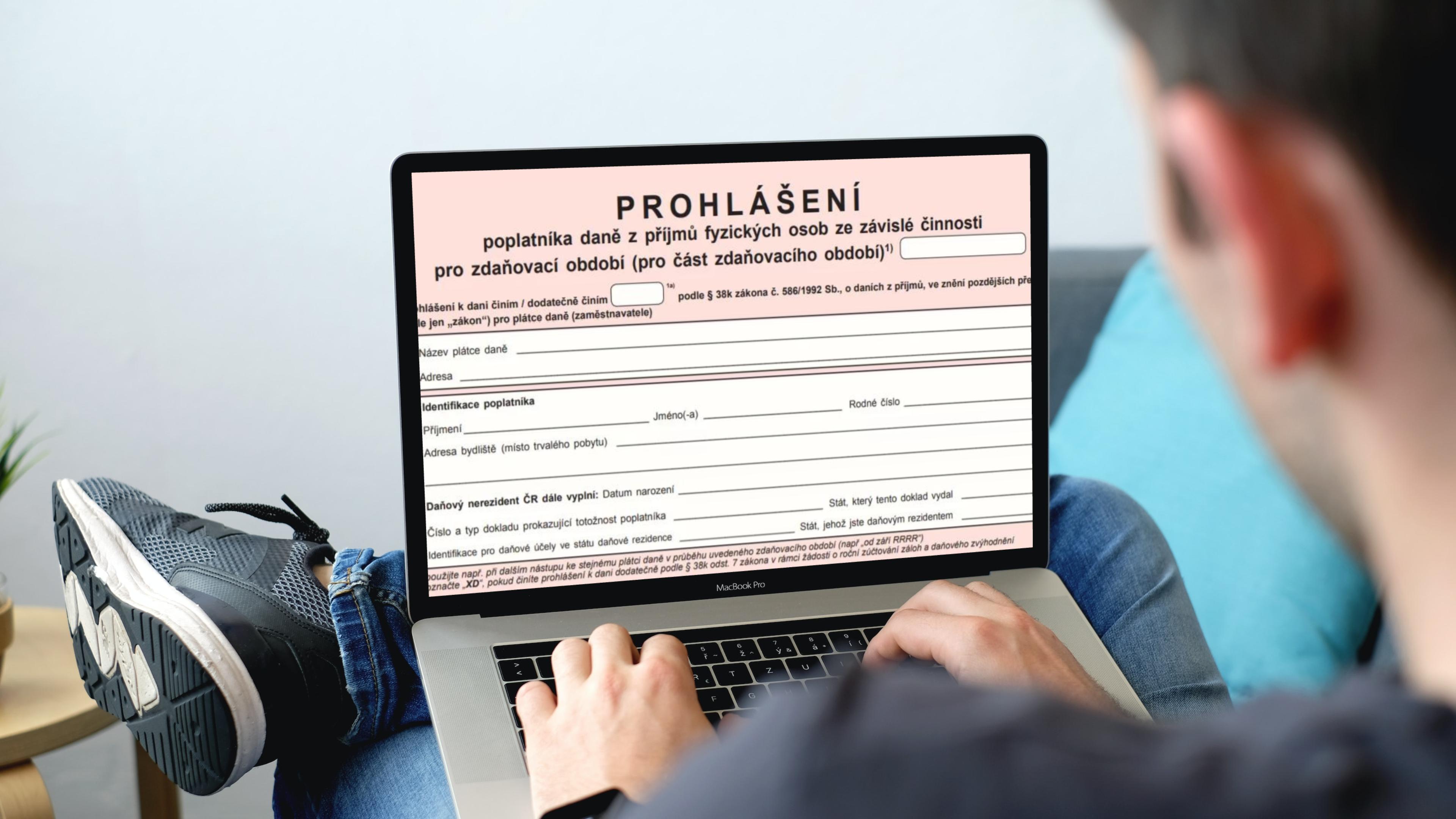

The tax return filing period can be a pain for many investors, especially if you are an employee with a signed pink slip and your other annual income exceeds CZK 6,000 (for 2023, this amount will be increased to CZK 20,000).

In other situations, you are obliged to file a tax return if your annual income not subject to the 15% withholding tax exceeds CZK 15,000 (for 2023, the amount will be raised to CZK 50,000). What do you need to think about and include in your tax return?

If you have invested funds with RONDA INVEST, you are subject to taxation under Section 10 – Other Income. This includes income in the form of any principal repayments (called settlements), income from participations, and other income such as bonuses and termination of participations that were actually credited to the investor’s account between 1 January and 31 December 2022. This income must be included in the tax return as it has not been taxed until then.

On the other hand, there are claimable expenses – the amount for which you acquired the participation. Obviously, you only need to be concerned about the claimable expenses when you actually earn the qualifying income.

The treatment of expenditure on the acquisition of an investment, unlike, for example, the sale of property, is specific. Just as the income from participations occurs gradually over periods (years), the application of expenses is to some extent gradual. In this case, you can think of the expenditure as a full basket from which you withdraw a certain amount each year until the basket is empty. Let’s take a simple example. In 2022, you buy a participation for CZK 100,000. You will not have your first income until 2023, namely CZK 10,000. Therefore, you do not enter anything in your tax return for 2022. In 2023, you list the CZK 100,000 from your basket as expenses, but only 10 thousand CZK. In contrast, you will report income of the same amount. No more is needed as the difference between income and expenditure will thus be zero for 2023. This will ensure that you will not pay any tax. In addition, you will have 90 thousand CZK more in your basket for the following years. You can do the same as in the previous year.

Report all income and claimed expenses in Schedule 2 of your tax return. For participations, use section 2, mark the line in column 1 as “F (Other income)”, then fill in Participations RONDA INVEST, fill in the income in the “Income” column, and the expenses claimed in the “Expenses” column.

Be sure to add the total of all other income and expenses on lines 207 (income) and 208 (expenses claimed). If you are filing your tax return electronically, this information will be filled in automatically. It couldn’t be easier.

Be sure to submit your personal income tax return for 2022 to the tax office by 3 April 2023 (in person or by post). If you file your return online via a data box or through the My Taxes portal, you have until 2 May 2023. Those who have their returns filed by a tax adviser have an extended deadline of 3 July 2023.

*Disclaimer: This article contains general information only. We are not tax advisors and do not provide tax advice. Your tax obligations are governed by the Income Tax Act No. 586/1992 Coll. If you are unclear, we recommend that you consult your tax advisor.

27. 5. 2024

I’ve got 100,000. What to invest in 2023?Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Hviezdoslavov (near Bratislava)

Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Urbanice near Hradec Králové

Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Zlin

The calculator calculation is based on a model example of a one-time repayment loan investment (full principal repayment at the end of the loan term). Returns are paid to investors monthly, and the calculator does not consider reinvestment. The actual performance of the investment may differ from the model example. It represents gross yield, subject to taxation. At RONDA INVEST, there are no entry fees or regular fees.