What should I do with my savings and extra money? With high inflation, is it better to save, spend, or invest? And if I should invest, where and what should I invest in? Let's compare the benefits and pitfalls.

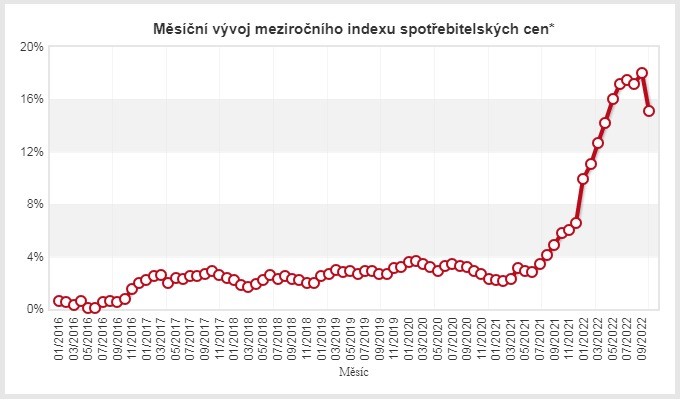

Leaving your money lying under your pillow or in your account is not a smart move. By the end of 2022, the difference between the rate of inflation and even the most generous interest-bearing bank accounts is more than 10%. Therefore, direct proportionality applies, indicating that the longer nothing happens to your savings, the less you actually have. Additionally, the higher the inflation rate, the faster you lose money.

So, where should you put your money or invest it to appreciate in value and create a passive income, while still having your funds available when needed? There are many options, but not all choices may be right for you. Every investor would like low risk, high return, and high liquidity. However, such an investment is virtually non-existent. When deciding what to invest in, there is almost always a trade-off you may or may not be willing to accept. What options can you choose from? What are the advantages and disadvantages? Let’s take a look together at the different forms of investment if you have spare funds of around CZK 100,000.

If you are already an experienced investor, take a look at how to further diversify your portfolio and what the current situation is for 2023. For complete beginners, let’s start with a small glossary of basic terms.

The general increase in the prices of goods and services over a period of time (most often compared year-on-year) using the consumer price index. The inflation rate is given as a percentage.

Investments refer to funds that are part of your income and are put into assets or ventures that do not bring immediate benefits but appreciate in value over time, as opposed to spending.

Liquidity indicates how quickly an investment can be converted back into cash. The higher the liquidity, the easier and quicker it is to convert the investment into cash. On the other hand, lower liquidity means that it may be more difficult and time-consuming to convert the investment into cash.

Interest is the monetary reward for lending money. When a lender (investor) temporarily lends a sum of money to a borrower, the borrower agrees to repay the principal amount along with an additional amount, known as interest, within an agreed period of time.

If you want to assess the value of your spare funds and make investments, it’s important to consider what is worth investing in and the associated risks. To help you make informed decisions, we have compiled a comprehensive guide detailing the pros and cons of the myriad investment options available.

[blog_offers_mobile]

Czechs most often entrust their savings to banks. In this case, we are not really talking about investments, but rather deposits. It is a form of saving money suitable for the short or medium term. For example, if you are planning to buy a new car in the near future, you might save the necessary funds in a current or savings account. However, neither current nor savings accounts can keep up with even one-third of the inflation rate.

At the end of 2022, the interest rates on savings accounts for a balance of CZK 100,000 ranged from 0.05% to 6.15% (averaging 4-5%). Savings accounts with higher interest rates above 5% usually come with additional fees and conditions. Meanwhile, the inflation rate reached a new record in the third quarter of 2022, with a year-on-year increase of 17.5%.

If you know you want to set money aside for a longer period, term deposits and building savings are common choices. The interest rate is fixed and conditional on not withdrawing the funds before a pre-agreed period.

A term deposit is used to hold funds for a few months to a few years. However, the interest rate is again lower than the current inflation rate, roughly comparable to savings accounts, ranging from 0.01% to 7.2%. Beware that term deposits at some banks may be significantly less profitable than ordinary savings accounts at other banks, and you cannot withdraw the money at any time.

[blog_offers_mobile]

Building savings is utilized for multi-year savings, and the state guarantees state support in this case. However, it is still essential to calculate and understand how to use the building loan, as its profitability decreases significantly under certain parameters. Even if you save more each year, the state support remains the same (maximum CZK 2,000 per year). The optimal way to achieve the highest state support is to save up to CZK 20,000 per year for six years, providing you with the maximum state support. Once you reach CZK 120,000 in savings (after six years), building savings may no longer be worthwhile, and there is an ongoing discussion about abolishing the state contribution.

Another investment option is to buy shares and bonds. Shares can pay a dividend (a share of the company’s profits), and you can also profit from shares if their price rises on the stock market.

Bonds are securities that certify a loan to an entity, such as a corporation, a city, or a state. The yield on the bond is then the interest, and further capital appreciation can be achieved, similar to a stock, if the bond’s price rises on the stock market.

Share purchases can be divided into two approaches. Firstly, the active approach involves following current trends and developments in a rapidly changing market and buying and selling individual stocks as you see fit. Secondly, the passive approach means choosing a representative sample of the market and replicating its index. One of the largest and best-known stock indices is the S&P 500 index, which includes the stocks of the 500 largest traded companies in the US. While indices may perform well in the long term, the problem is that you cannot predict the market in advance. In 2022, even the S&P 500 generated a loss of more than 15%.

Similar negative developments were seen in 2022 for other major indices, such as the MSCI World, composed of the most important stock markets outside North America, including Europe, Australia, and the Far East. This index declined by a full quarter from January to the end of 2022, with the Nasdaq 100 and the Japanese Nikkei 225 also in negative territory. Whether global equities will continue to fall in 2023 or the trend reverses will be determined by many as yet unknown factors. If you intend to save your money for decades, you may use this crisis to buy cheap stocks. However, if you expect appreciation within a year or a few years, you could face potential losses.

Mutual funds are highly popular in the Czech Republic and worldwide, making them one of the most common types of investments. The fund itself allocates your finances into sub-investments within its portfolio. It provides expertise, so you don’t have to worry too much, but you also pay fees, and you lack decision-making power over the distribution of investments, while the exact amount of return remains unknown in advance. It is crucial to carefully consider the strategy of a particular mutual fund, especially how it minimizes risks in its investments and ensures their security. Typically, investment appreciation is measured in percentages, although some funds focus on dynamic sectors (AI, biotech, sustainability) that can yield even higher annual appreciation.

[blog_offers_mobile]

Following the development of the stock markets in 2022, most mutual funds will generate losses for Czech investors, and 2023 is likely to bring further deterioration due to the economic crisis.

Investments in cryptocurrencies, electronically created digital currencies, are booming. For example, those who seized the opportunity to invest in Bitcoin in its early days could have seen their wealth appreciate by more than 1,000%. However, the tremendous rise has been accompanied by a tremendous fall. High-risk investments, therefore, should be made with free funds, where you will not regret any loss, as it is more likely to occur.

Iconic Bitcoin is at its lowest since the beginning of 2022, with its value down more than 75% from November 2021 to November 2022. For its risk-averse backers, this could theoretically be a good buying opportunity.

Especially in times of crisis when it is not worth keeping cash, people naturally invest in valuable assets. This can include art, vintage wines, rare rums, or collector’s editions of various kinds. Investing in precious metals, especially gold, silver, or platinum, has also been popular over the long term.

Benefits of investing in gold and other commodities

Disadvantages of investing in gold and other commodities

The price of gold has been steadily rising to new all-time highs since 2020, so whoever bought it about 3-5 years ago will reap the benefits in 2022. However, the price of gold is determined purely by the sentiment of other market participants; it does not appreciate in any way nor produce another flow of money – it is a store of value, not an appreciator of value. The rise in the price of gold and precious metals is therefore historically as common as its fall. After a long rise, a fall is inevitable; it’s just that no one knows exactly when the break will come.

Crowdfunding is a popular form of investment based on the principle of non-bank loans and support for interesting projects. Several smaller investors pool together a larger sum to finance an investment project. Interest rates are in the high single digits, or even in the low teens for riskier projects. In the Czech Republic, crowdfunding has been most prominently introduced by Zonky. Crowdfunding platforms often offer rewards other than interest payments, such as tangible prizes.

Real estate prices rise steadily with inflation, and in the long run, investments usually yield very good returns. Recent years have brought turbulence – with the advent of COVID, domestic real estate prices have risen extremely fast, increasing by a leap of 25-30% in the Czech Republic since the beginning of the pandemic (spring 2020 – winter 2021). With the economic crisis related to the war in Europe, a price correction is expected. However, prices are unlikely to return to the values of 2-3 years ago. Overall, from a long-term perspective, real estate is one of the most conservative ways of investing, and interest in it will never cease; even short-term corrections will not change the growth trend.

If we are talking about an investment of up to CZK 100,000 without a mortgage loan, it is possible to acquire various types of land (but not building land), garages, cellars, and other properties in less desirable locations in the Czech Republic. Of course, you will not be able to buy an apartment, a house, or a building plot for this price. If you can rent out your property (such as the garage mentioned above), it can be a nice investment start. However, you also need to take into account operating costs, property tax, and other expenses.

[blog_offers_mobile]

Some investment platforms combine more than one of the above. For example, if you want to invest with an attractive return but are more conservative in terms of risk, you may choose to invest in business loans secured by real estate. This option is offered by the RONDA INVEST platform.

Clearly, letting your finances appreciate in value makes sense. Deciding where to invest properly in 2023 is particularly tricky. Have you made your choice?

Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Hviezdoslavov (near Bratislava)

Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Urbanice near Hradec Králové

Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Zlin

The calculator calculation is based on a model example of a one-time repayment loan investment (full principal repayment at the end of the loan term). Returns are paid to investors monthly, and the calculator does not consider reinvestment. The actual performance of the investment may differ from the model example. It represents gross yield, subject to taxation. At RONDA INVEST, there are no entry fees or regular fees.