Do you understand the significance of your investor profile and know where to easily access valuable information? The Ronda Investment Portal underwent comprehensive optimization some time ago. We would like to guide you on how to efficiently search for crucial information and navigate through the application's contents.

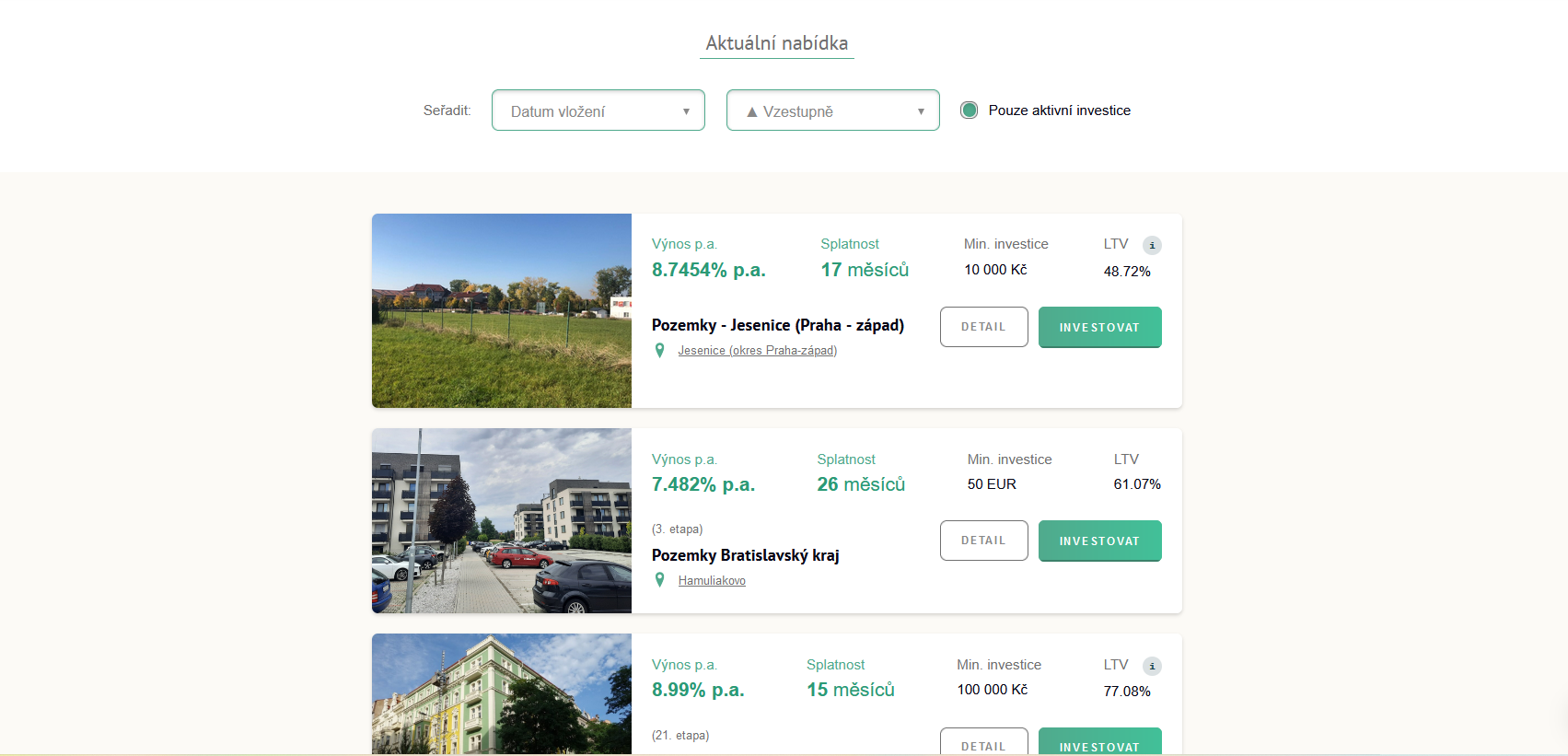

Upon logging in, you will be presented with the current list of available investment projects. You can easily compare these projects and click on the ‘Detail’ button to access more information about each one. Utilizing filters, you can also view previously closed projects or sort them according to your preferences.

In the top bar, you’ll find several tabs, each concealing different information.

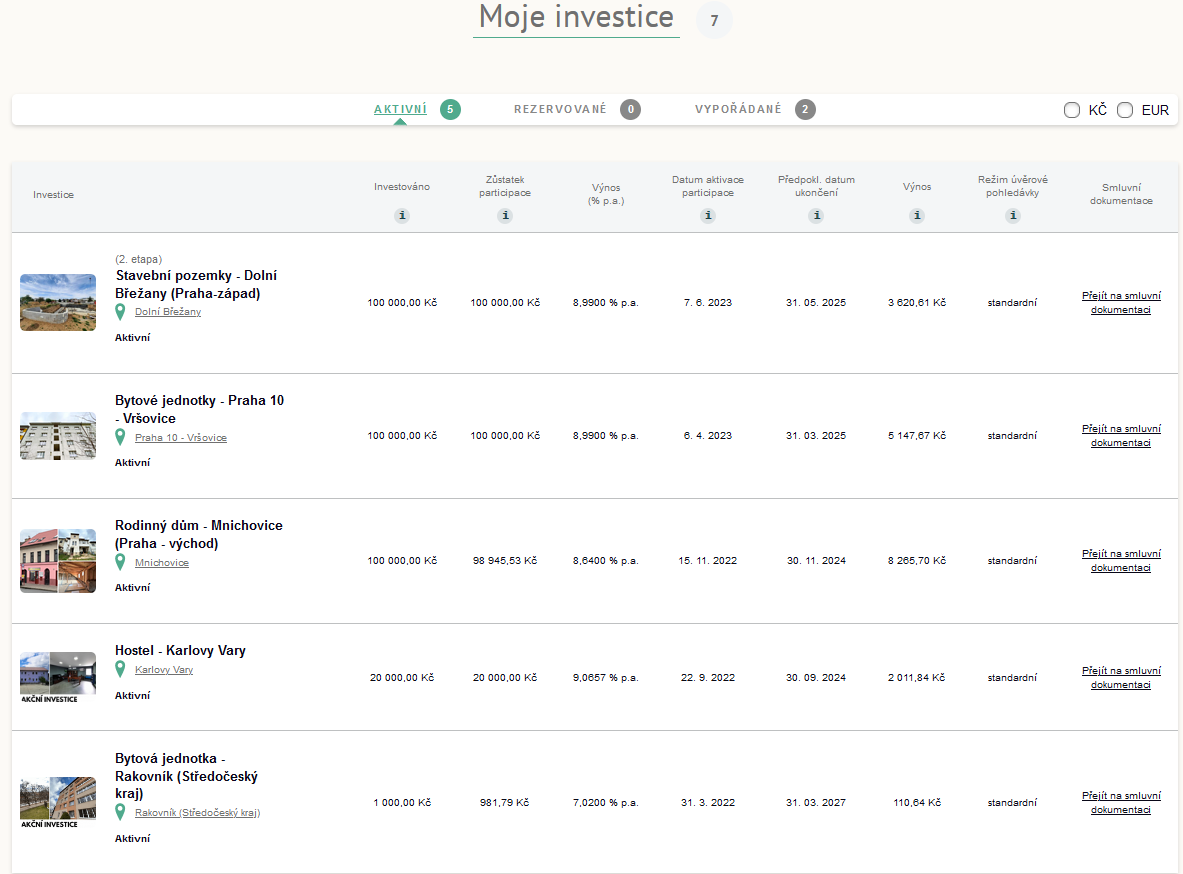

A preview of your CZK investments will be automatically displayed. If you have euro investments in your portfolio that you want to view, simply switch the button in the top right corner from CZK to EUR.

The “My Yield” tile shows the amount corresponding to the sum of yields from all active and settled participations, excluding any bonuses.

The “Diversification” tile either indicates that you have only 1 investment and should consider selecting another to reduce risk, or it presents a clear ratio of all your investments in a pie chart.

As you scroll down the page, you will find the “My Investments” section. This is a clear list of all your active, reserved, or settled investments that you can click through and review one by one. For each investment, there is an activation date and an expected end date. Once again, you can categorize your investments into CZK and EUR in the right-hand corner.

We strive to make the Portal Ronda as user-friendly and intuitive as possible. Your feedback is highly valued, so please do not hesitate to contact us with any inquiries or suggestions.

27. 5. 2024

I’ve got 100,000. What to invest in 2023?Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Hviezdoslavov (near Bratislava)

Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Urbanice near Hradec Králové

Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Zlin

The calculator calculation is based on a model example of a one-time repayment loan investment (full principal repayment at the end of the loan term). Returns are paid to investors monthly, and the calculator does not consider reinvestment. The actual performance of the investment may differ from the model example. It represents gross yield, subject to taxation. At RONDA INVEST, there are no entry fees or regular fees.