The end of summer, much like the start of a new calendar year, is a time when many of us reflect on our progress, both personally and professionally. It’s a moment to assess how far we’ve come and what still lies ahead. For our investors—and for those of you who have yet to join our investment platform—here are the results of 2024 so far.

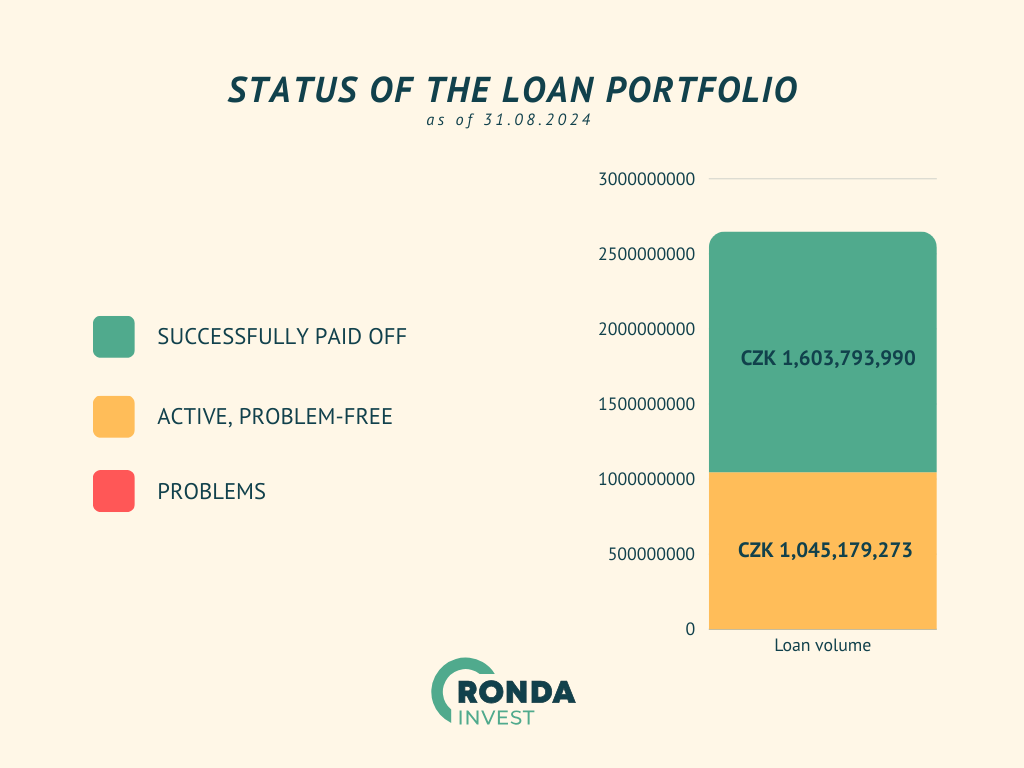

The numbers speak for themselves: we consistently pay out investments and all yields on time, with no shortfalls. Your trust and savings are of the utmost importance to us.

Our investment platform continues to maintain 100% reliability in paying out both the original amounts invested and the yields earned. After all, what more can you expect from an investment platform than to receive exactly what was promised? We consider this our standard and are proud to be outperforming the market benchmark.

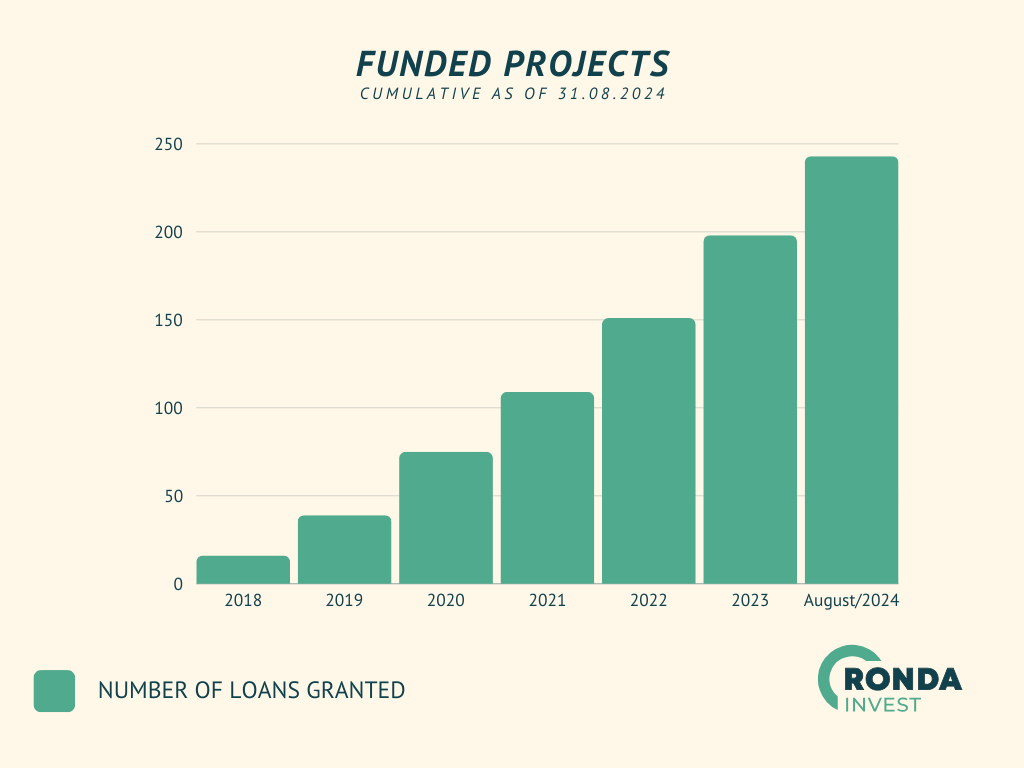

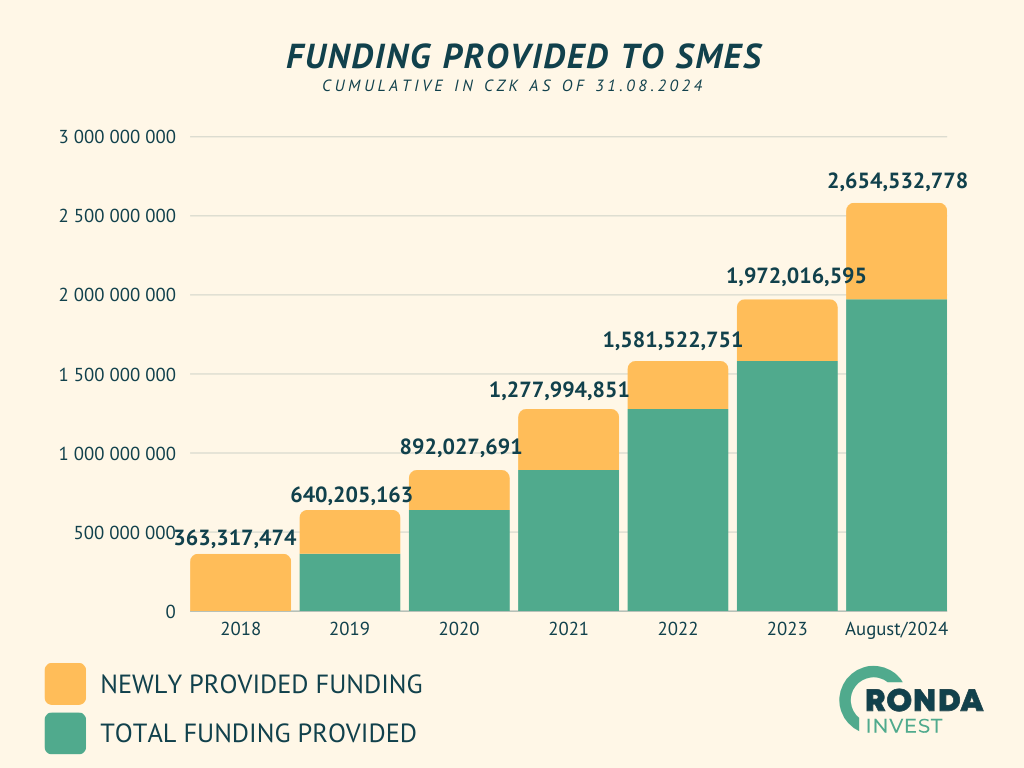

The successful repayment of many of our projects has motivated us in providing even more new financing, ensuring our investors continue to enjoy a wide and diverse range of investment opportunities. Since the beginning of our operations up to 31 August 2024, we have financed a total of 243 projects, amounting to CZK 2,654,532,778. This summer alone, we funded 16 new projects with a combined value of CZK 296,250,000.

We had a busy summer – how much did we pay out to investors?

The summer months were not so relaxing for us. We paid out CZK 284,330,026 during the summer holidays. Of this, over CZK 13 million was paid out in yields. These were record months in terms of amounts settled and therefore activity with our investors, who immediately reinvested 76% of the funds paid out in current projects. Nothing is a better indication of your satisfaction with our service than such natural investment activity.

Despite the growing ranks of our happy investors, we are holding on and constantly striving to improve the quality of our service. In addition to our revamped Client Referral Program and newly launched Affiliate Program, you may have met us at reputable events in recent weeks such as the HN Fire Investment Conference, Finfest & Realityfest, and the upcoming Real Estate Forum, all of them are held in Czech republic.

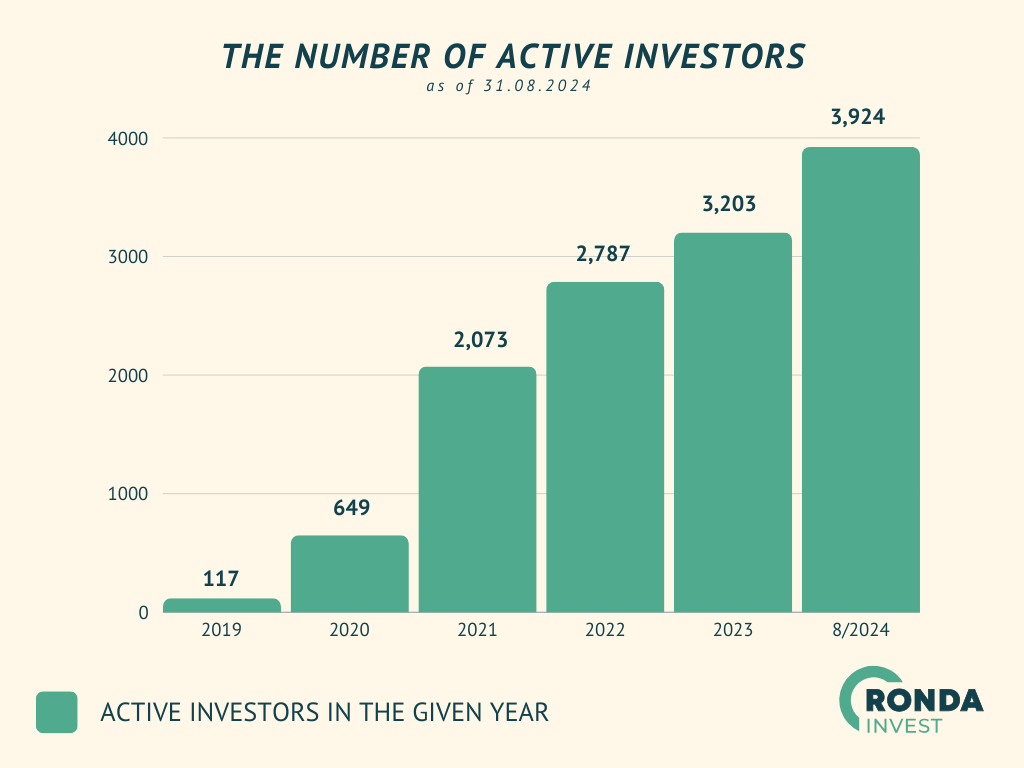

We are approaching a new milestone and that is 4,000 active investors. Investors are currently investing with us at a weighted average rate of annual yield of 8.2%. Despite the slight reduction in the yields offered, which we have had to make in connection with the economic development and the lowering of the base interest rate, the appreciation of money within conservative investment products is holding high and provides a real appreciation far surpassing that of savings accounts or time deposits.

Our professionals bring years of expertise, which directly enhances the quality of our operations. Sales Director Lukáš Blažek has over 25 years of experience in business financing and development, while Radoslav Jusko, with nearly 20 years of experience in risk management, ensures the 100% reliability of commitment disbursements. Ronda’s success is built on a team of experienced professionals who collectively contribute to the platform’s growth.

Our top priority is to meet all obligations to investors, and central to this is ensuring high-quality collateral for every loan we issue. The strength of our portfolio is the best proof of this.

Each loan we originate is secured by a first-lien mortgage on real estate, with an LTV ratio of up to 70%, and further safeguarded by a notarized deed of trust. Thanks to this approach and our creditworthy borrowers, we have no repayment issues.

Thanks to our many years of experience and track record, investors particularly appreciate the stability of our platform. We view our investors as business partners and do not delegate administrative duties. We focus on what we do best.

27. 5. 2024

I’ve got 100,000. What to invest in 2023?Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Prague - Dubeč

Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Všemily - Jetřichovice (okres Děčín)

Yield

The return represents the amount of money you get for the capital invested. It indicates the difference between the final value of the investment and the capital employed.

p.a. means per annum, i.e. yield calculated on an annual basis.

Example:

You invest CZK 10,000 with a return of 10% p.a. We will pay you the income in a proportional amount every month, you will get a total of CZK 1,000 in income per year.

Maturity

The maturity date indicates the binding date by which the loan will be repaid and when your investment ends.

After this date, we will send the original invested amount to your account along with the last return.

Min. investment

The minimum investment indicates the lowest possible amount that can be invested in the project.

LTV

LTV = Loan to Value

(translated as “loan to value”)

LTV indicates the ratio of the property’s value to the loan’s value. The lower the LTV, the higher the collateral.

LTV calculation = loan amount / estimated market price × 100

Frýdek - Místek, Havířov, Šumperk

The calculator calculation is based on a model example of a one-time repayment loan investment (full principal repayment at the end of the loan term). Returns are paid to investors monthly, and the calculator does not consider reinvestment. The actual performance of the investment may differ from the model example. It represents gross yield, subject to taxation. At RONDA INVEST, there are no entry fees or regular fees.